Winter Season

It’s April, at the end of the winter season 23/24, it is snowing outside and the forecast for the next few weeks is for the temperature to remain in single figures. In fact last night was the coldest April night ever recorded in some parts of France. What a contrast to this past winter season! It will be remembered as warmer and wetter than the historical average. For much of the season the snow depths above 1500m were normal. So at Avoriaz/Flaine the conditions were generally very good. And on the ski areas around Chamonix they had more snow than usual. This contrasted with difficult conditions when skiing back into the villages. The people that run businesses in this area worry about the weather in the same way a farmer does. We worry that people on holiday will be disappointed, we have quizzed many people and I know others did too, and the face to face feedback has been universally good. That contrasts with a small number of people trolling on social media, but then, I guess that is what you get on social media isn’t it?

We asked a number of people looking in the area, why they are buying, are they not worried about “climate change”. The response is always the same, guaranteed skiing is not the main driver for a purchase. There are so many ways to enjoy these mountains.

I am discussing the conditions, because they always influence the interest we observe for second homes. Overall, this season mirrored the preceding one of 22/23, rendering it average—akin to pre-pandemic years. This equilibrium extended to both buyers and sellers.

Mortgages and affordability

Last year, the market experienced a cooling off due to mortgage accessibility challenges. Fortunately, this hurdle has since eased, with rates now dipping below 4% for select buyers. For those relocating from abroad, mortgage options exist to safeguard against potential rate drops, such as variable/tracker mortgages or those without redemption penalties. Exploring such products may necessitate consulting a broker rather than relying solely on high street banks.

Saying that, the property market in the ski areas has been supported by people that don’t really need a mortgage to buy the property they want. The buyers around here are investing their money in property which is a safe “asset”, the downside for people that live in the area is that the affordability of property ends up out of reach. This is in contrast to the rest of France where most people will require a mortgage for their homes, this difficulty in obtaining a mortgage has meant prices in much of the rest of France are reducing, in time this should make affordability easier. In general over the last year, prices across France are down 10%. Sales are down 30% which is a big issue if you are an estate agent. Plenty are closing down. PACA (the area around Nice) has bucked that trend, as we have in the Haute Savoie.

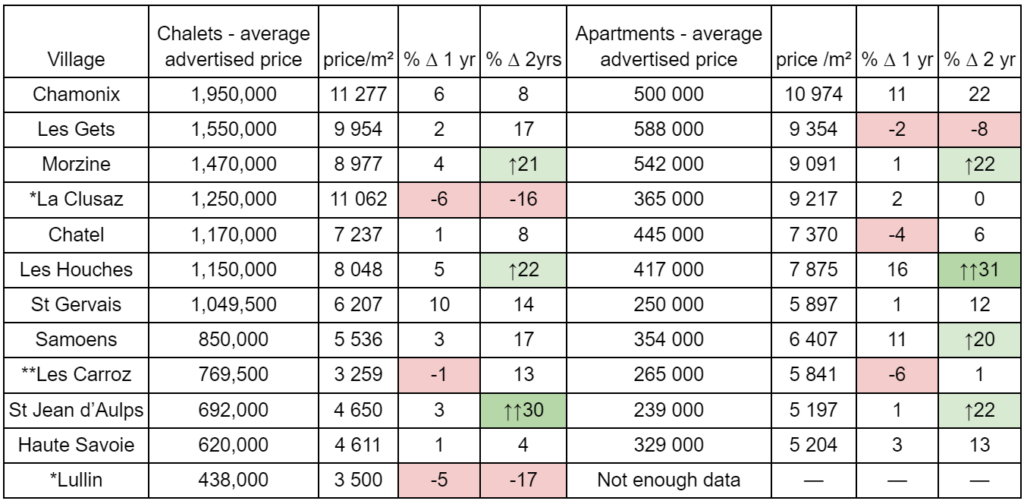

Price Trends

I’ve had a look at the price trends across the ski areas we cover. We now have access to ALL the sales data across France and to real time data for what is for sale.In general over the last 2 years we have seen price rises of up to 30%, with an average of 18%.

* I don’t think we have enough data to trust these

** Same for Les Carroz, thanks to a problem with Insee and the Code Postal in that area

Our Commitment to 1% for the Planet

In previous market reports, I’ve emphasised our profound appreciation for our mountain environment, our commitment to sustainable transportation, and our cautious stance on unrestrained growth. Despite often feeling powerless to enact change and pointing fingers at local and central governments, we’ve taken tangible action in recent years. We’ve aligned our actions with our values by joining 1% for the Planet, allocating 1% of our turnover (not just profit) to local accredited environmental organisations. Even during lean times, we will uphold this commitment. In the past 18 months alone, we’ve contributed over €40,000 to these causes. Notably, Montagne Verte, a group based in the Portes du Soleil, has been a primary beneficiary, spearheading initiatives to mitigate our local environmental impact. I strongly encourage you to learn more about their work. Additionally, we proudly support Association un Rêve d’Abeilles, which educates schools and youth organisations on the vital role of pollinators, alongside Ecotrivelo and Inspire, both based in Chamonix. You can read more about all these initiatives here

https://blog.alpine-property.com/2024/04/04/one-percent-for-the-planet/

St Jean d’Aulps is featured in one of the fastest growing categories in my analysis. The video below shows you why.

The Chamonix valley has shown strong and sustained growth over the last couple of years. Take a look at this property in Vallorcine.

Previous reports:

November 2023 – https://blog.alpine-property.com/2023/11/07/alpine-property-market-report-november-2023/

June 2023 – https://blog.alpine-property.com/2023/06/15/alpine-property-market-report-june-2023/