The overall global picture hasn’t shifted dramatically since my summer report. While the war in Ukraine continues, its direct impact on daily life and the European property market has stabilized. Similarly, geopolitical shifts in Gaza and the US political landscape are creating less immediate market volatility than in previous cycles.

Economic Outlook: French vs. UK Property Markets

A genuine positive for the French Alps property sector is that inflation in France has steadied; forecasts sit at 1% for 2025. This contrasts with the UK (4%), where higher living costs and a weaker pound continue to influence the purchasing power of British buyers.

Crucially for investors, French mortgage rates are now below 4%—more competitive than typical UK rates. Furthermore, French lending restrictions have relaxed slightly, providing a welcome boost for those looking to finance a mountain second home.

Morzine Property Trends: High Demand & Price Growth

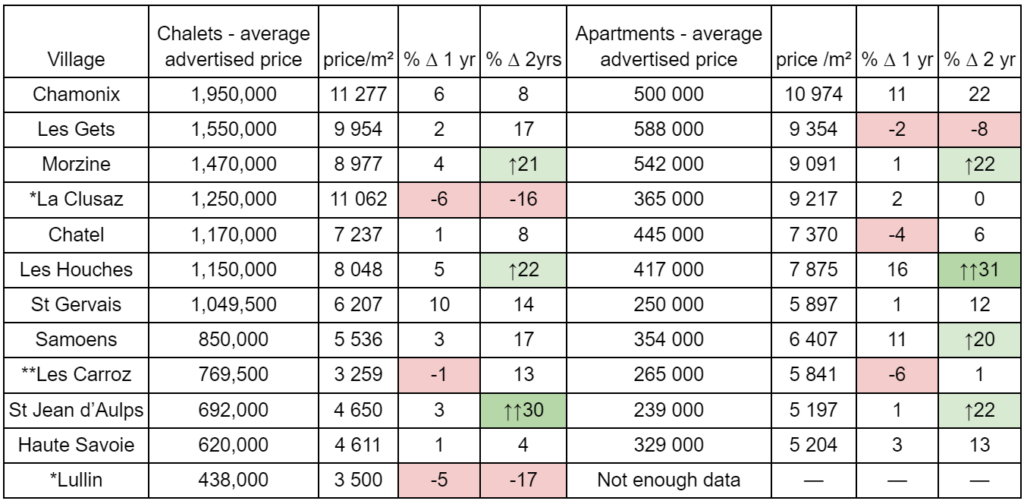

In Morzine, transaction volumes remain high enough to provide robust data. According to the Notaires and current market indicators, asking prices for apartments in Morzine have risen approximately 28% over the past year, and 12% since the start of the summer.

This growth hasn’t been linear. While prices appeared to soften at the end of the last winter season, the market stabilized over the summer and has strengthened markedly through the autumn.

Advice for Sellers: Actual selling prices often lag behind asking prices. While buyers are making confident, realistic offers, we advise sellers to take “below asking price” offers seriously. Properties priced too optimistically are starting to “stick” on the market.

The Morzine Chalet Market & Luxury Segment

The chalet market in Morzine tells a different story. For mid-range chalets (around the €1 million mark), asking prices rose by 8% this year, but Notaire figures suggest a dip in actual selling prices.

At the luxury end (above €1 million), demand has weakened slightly in 2025. This is likely linked to global investment patterns; with the stock market hitting record highs, capital is currently flowing into AI equities rather than traditional real estate. It is a reminder that even prime Alpine property is not entirely immune to broader economic trends. If / when the AI bubble bursts expect the money to return property!

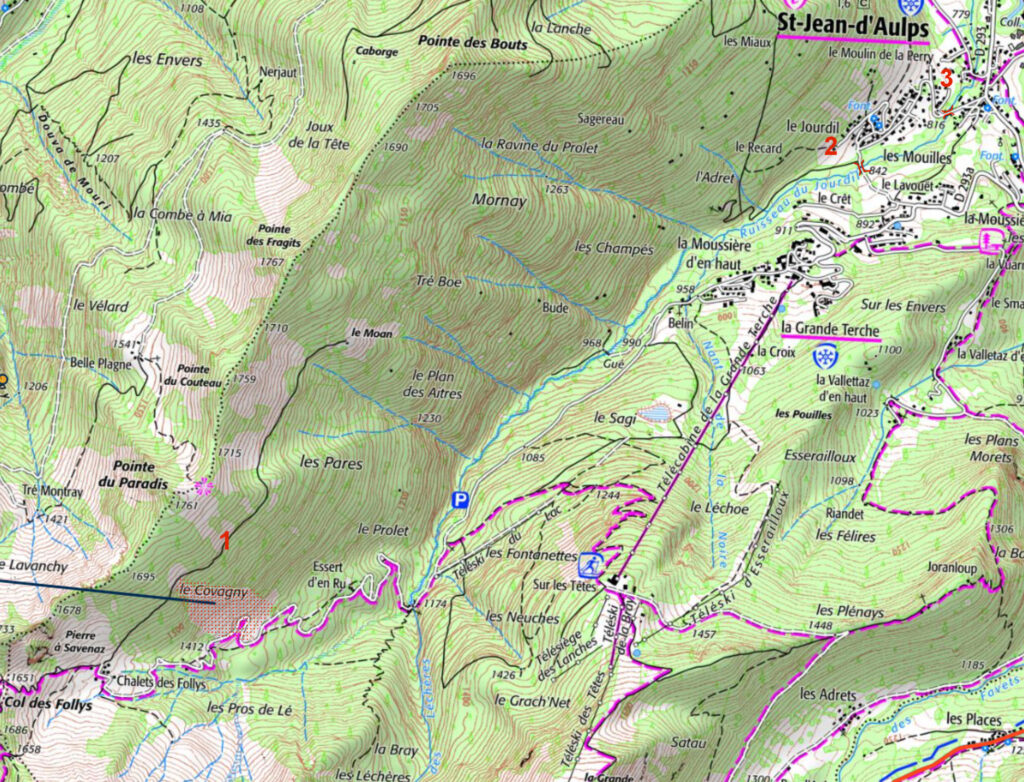

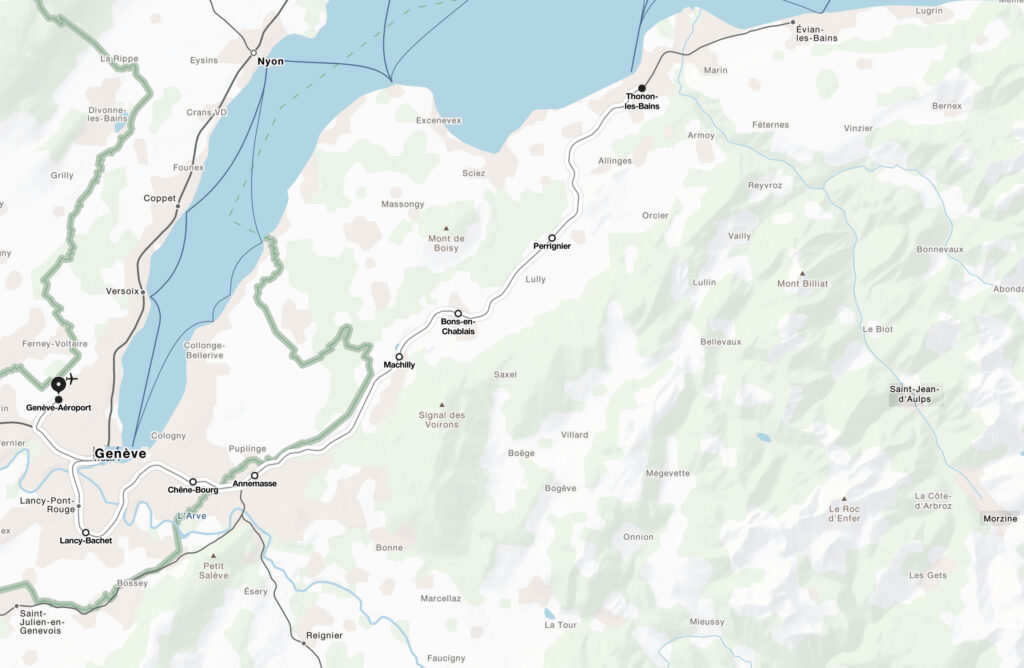

Vallée d’Aulps: St Jean d’Aulps & The “Sweet Spot”

Heading down the Vallée d’Aulps, the outlook remains very positive. Demand for chalets in St Jean d’Aulps under €1 million is strong, with a “sweet spot” for buyers around €700,000. Data indicates a 30% increase in value over the last year.

For apartments in St Jean d’Aulps, the highest demand is for “four-season” practical homes. Buyers are prioritizing:

- Storage space: Garages and large caves (lockers) for bikes.

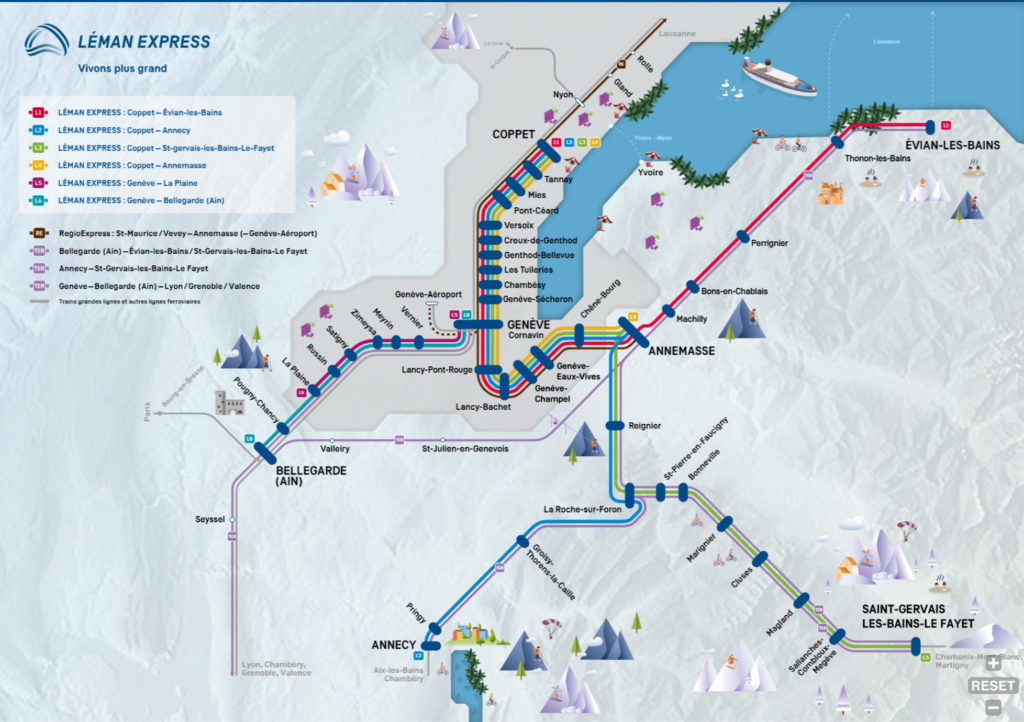

- Year-round accessibility: Proximity to main ski-bus routes.

- Function: Space for extended stays rather than just one-week holidays.

Sustainability and the “Four-Season” shift

That shift towards year-round living ties into a wider issue that’s recently been highlighted by the Cour des Comptes (France’s administrative audit authority). Their reports suggest that local administrations remain too dependent on winter tourism and need to invest more in non-ski activities. This is not news, but it is becoming more urgent.

Morzine’s finances are cushioned by substantial dividends from SERMA, the company operating Avoriaz’s ski lifts. This provides a valuable safety net and could well be masking more systemic issues in Morzine.

By contrast, St Jean d’Aulps lacks that financial buffer. Its ski area, Le Roc d’Enfer, is supported directly by the commune, and its long-term sustainability looks fragile. That’s unfortunate, because it remains one of the region’s best-value ski areas – offering fantastic and usually quiet skiing at less than half the cost of Avoriaz. The best way we can help is to keep skiing there. In practice, most homeowners in La Grande Terche already split their time between Roc d’Enfer and trips to Ardent, Morzine or Les Gets, so even if the ski area’s future becomes uncertain, local property demand seems unaffected. Perhaps that’s why SERMA has shown little interest in stepping in – after all, if the Roc d’Enfer were to close, its skiers would simply head to Avoriaz instead.

Looking Ahead to 2026

As we move into the 2025/26 winter season, the market across Morzine, Les Gets, and the Vallée d’Aulps remains fundamentally strong.

- Mid-range apartments are the top performers.

- Morzine chalets require more strategic pricing to secure a sale.

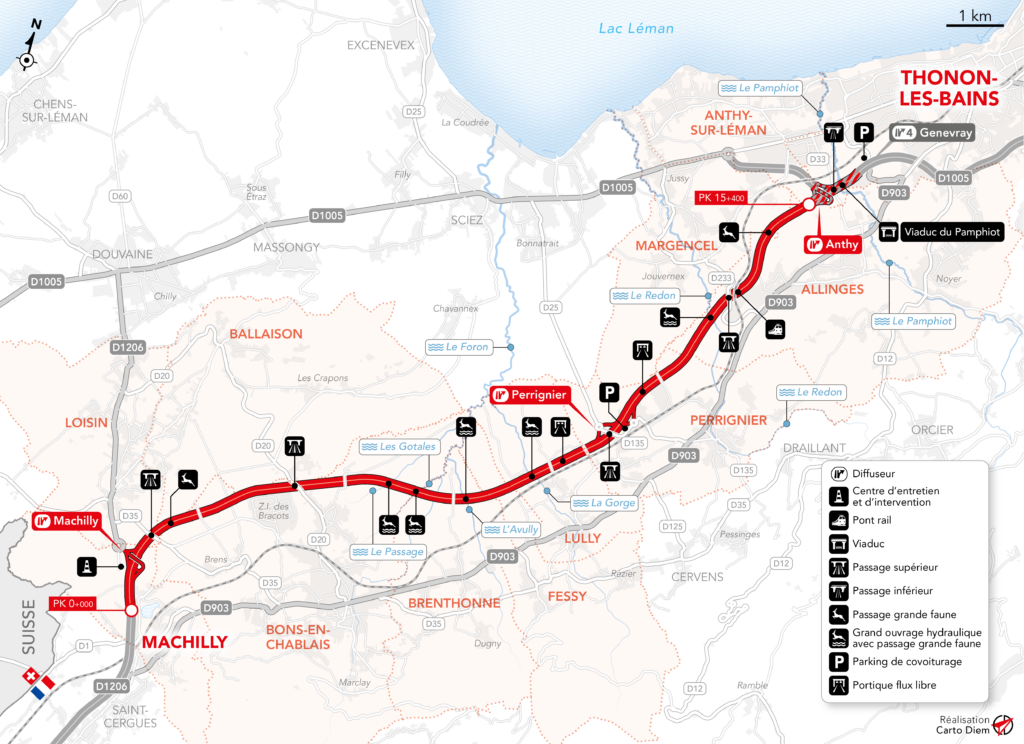

- Buyer sentiment is underpinned by a desire for mountain lifestyles and improved local infrastructure.

Whether you are looking for investment potential or a permanent move to the mountains, there is a wider choice of property available now than we have seen in years.

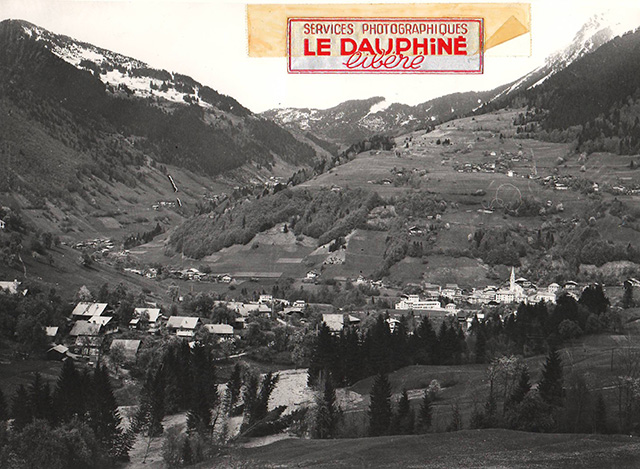

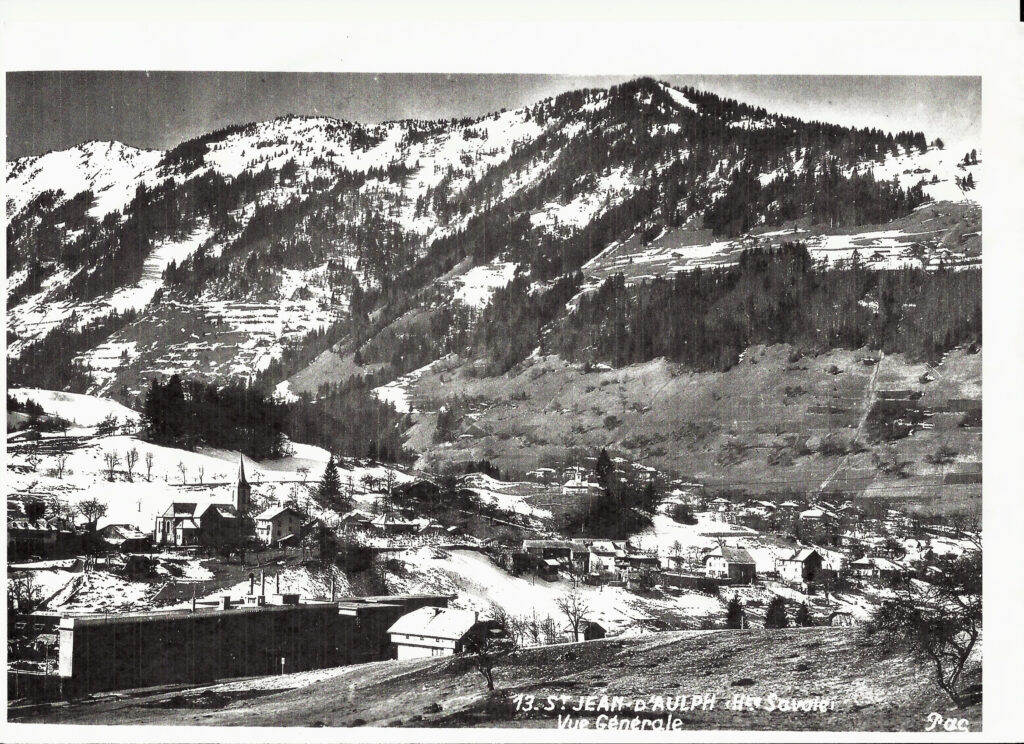

Below is a picture of the finished Clos Florine project at La Grande Turche (St Jean d’Aulps), full details are available here.