Brexit and buying a property in France: Some FAQ’s

The UK’s departure from the EU has a number of consequences for British nationals buying and selling properties in France. Below we have set out some of the main changes and how we think they will impact our customers.

If I am looking to buy in France, does Brexit make it more expensive for me?

No, there are no additional costs for non-residents looking to purchase in France after 1 January 2021. Acquisition costs will remain at about 7 to 8% for an existing property and around 2.5% for a new-build home.

What changes if I want to sell my property in France?

This is where the changes are. It’s all to do with Capital Gains Tax.

Capital Gains Tax (CGT)

CGT has always been payable if your property has increased in price. Don’t forget that, if your sale attracts tax, this indicates an increase in value in your property, which is largely a positive outcome!

Primary residences are still exempt from CGT.

If a second home has increased in value, CGT is levied on the increase. In France, there are two payments due on a capital gain, the CGT and a social levy.

The standard CGT on the sale of a property will remain at 19%. The standard social levy charge for EU residents with a second home in France is currently 7.5% but this has increased to 17.2% for British homeowners from 1 January 2021. This means the total tax now due on a capital gain will be 36.2%, up from 26.5%.

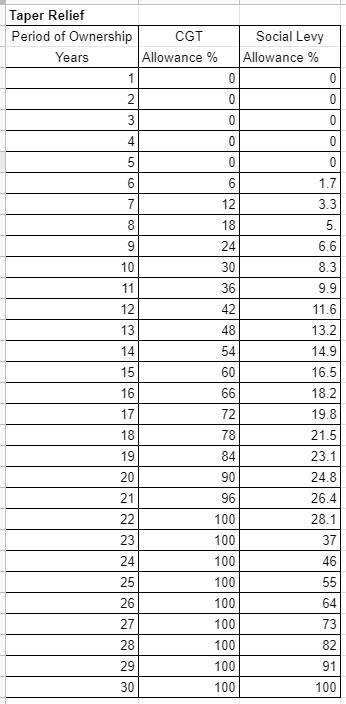

BUT a taper relief also exists for both CGT and the social levy. For CGT the rate decreases from 6 years of ownership, with no CGT due after 22 years. The social charge taper also starts at year 6 with no charge applicable after 30 years of ownership. You can see this in the table below.

To deal with these taxes, in the majority of cases, a non-EU resident selling a second home in France will be required to appoint a fiscal representative. There are exemptions where the sale price is under €150,000 or if the property has been owned for 30 years or more. The fee for this can range from 0.5% to 1% of the property’s sale price, payable out of the sale proceeds but deductible as part of the CGT calculation.

We have another blog post on the subject of how to spend more than 90 days in France.

I am a UK resident who purchased a second/holiday home in Brittany in 1988. Purchase price was approx £40k. Much work has been done to renovate and enlarge the property but some of the work has been done by ourselves so minimal receipts available. Current value would be around £400k.

Please can you clarify what tax would be payable both in France and in the UK. (eg, as owned for over 30 yrs, are both CGT and Social levy no longer required?)

I’d say that if you have had it for moe than 30 years there would be no CGT or Social Levy to pay in France BUT you need to see what you will owe in the UK AND you must get this checked with your Notaire before you make any decisions based on this information. ALSO ae have been hearing from the Notaires that something has changed (in the favour of foreign residents) with the social levy. We are not up to date with the exact situation. I found this – but you can’t trust that it is up to date ! http://plus-values.notaires.fr/simulateur/index.xhtml